Πρόσφατα, η τιμή του αργού πετρελαίου αυξήθηκε αρχικά και στη συνέχεια μειώθηκε, με περιορισμένη ώθηση στο τολουόλιο, σε συνδυασμό με χαμηλή ζήτηση ανάντη και κατάντη. Η νοοτροπία του κλάδου είναι επιφυλακτική και η αγορά είναι αδύναμη και φθίνουσα. Επιπλέον, έχει φτάσει μια μικρή ποσότητα φορτίου από τα λιμάνια της Ανατολικής Κίνας, με αποτέλεσμα την ανεπαρκή κατανάλωση και μια μικρή μείωση των αποθεμάτων. Ορισμένα διυλιστήρια έχουν υπερθερμανθεί και επανεκκινήσει, με αποτέλεσμα μια μικρή ποσότητα εξαγωγικών πωλήσεων και μια αύξηση της παραγωγής, με αποτέλεσμα μια συνολική αύξηση της εγχώριας προσφοράς τολουολίου. Το παραδοσιακό τμήμα TDI κατάντη του διυλιστηρίου έχει κλείσει και χρειάζεται μόνο προμήθεια. Η τρέχουσα μείωση των πρώτων υλών έχει συρρικνώσει την αγορά τολουολίου, ενώ η ζήτηση κατάντη είναι χαμηλή, με αποτέλεσμα τον χαμηλό πραγματικό όγκο συναλλαγών.

Η κατάσταση των τιμών του πετρελαίου

Από τις 11, ο αριθμός των αρχικών αιτήσεων για επιδόματα ανεργίας στις Ηνωμένες Πολιτείες έχει αυξηθεί και το ζήτημα του ανώτατου ορίου χρέους συνεχίζει να εγείρει ανησυχίες στην αγορά, οδηγώντας σε πτώση των διεθνών τιμών του πετρελαίου. Το συμβόλαιο μελλοντικής εκπλήρωσης αργού πετρελαίου NYMEX 06 μειώθηκε κατά 1,69 δολάρια ανά βαρέλι, ή 2,33%, στα 70,87. Το συμβόλαιο μελλοντικής εκπλήρωσης πετρελαίου ICE 07 μειώθηκε κατά 1,43 δολάρια ανά βαρέλι, ή 1,87%, στα 74,98. Το κύριο συμβόλαιο για τα μελλοντικά συμβόλαια αργού πετρελαίου China INE, 2306, μειώθηκε κατά 2,1 στα 514,5 γιουάν/βαρέλι, ενώ μειώθηκε κατά 13,4 στα 501,1 γιουάν/βαρέλι στις νυχτερινές συναλλαγές.

Κατάσταση συσκευής

Ανάλυση παραγόντων που επηρεάζουν την αγορά

Η τρέχουσα στήριξη του κατώτατου σημείου της αγοράς είναι καλή και η προσφορά αυτοκινητιστικών μεταφορών έχει μειωθεί. Ωστόσο, η κατανάλωση αποθεμάτων στα λιμάνια έχει επιβραδυνθεί και η ζήτηση στα κατάντη τερματικά παραμένει υποτονική. Η στάση του ιδιοκτήτη της επιχείρησης είναι κυρίως «περιμένω και βλέπω».

Πρόβλεψη μελλοντικής αγοράς

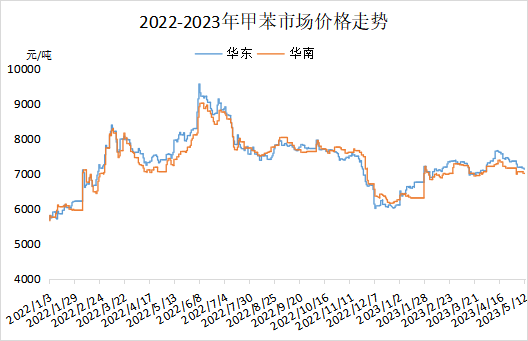

Προς το παρόν, η προμήθεια βενζίνης από τη βιομηχανία παραμένει σημαντική υποστήριξη για την αγορά τολουολίου. Οι μονάδες Secco, Taizhou, Luoyang και άλλες έχουν προγραμματιστεί να τεθούν εκτός λειτουργίας για συντήρηση στα μεσαία και μεταγενέστερα στάδια, με αποτέλεσμα τη μείωση της προσφοράς. Υπάρχει επίσης αστάθεια στην προμήθεια βενζίνης, με αποτέλεσμα την επιβράδυνση της αγοράς τολουολίου και την υποτονική ζήτηση κατάντη. Επομένως, η θετική υποστήριξη από την πλευρά της προσφοράς αντισταθμίζεται, με αναμενόμενο εύρος λειτουργίας 7.000 έως 7.200 γιουάν/τόνο.

Ώρα δημοσίευσης: 15 Μαΐου 2023